FAQ

£218 million was invested by Epiris (formerly Electra Partners) on behalf of Electra Private Equity (“Electra”) including:

- £89 million invested in Photobox Group

- £45 million invested in Retirement Bridge Group

- £21 million invested in debt instruments of Hollywood Bowl Group

- £19 million invested in Cordatus VI

- £13 million invested in Tymon Park

- £9 million invested in Sparrows

- £7 million invested in two secondaries transactions

£903 million (inclusive of income) was realised, a record level for Electra, including:

- £199 million from the sale of Elian

- £153 million from the IPO of Hollywood Bowl Group

- £110 million from AXIO Data Group in respect of the sale of the MIMS business; the refinancing of the OAG business; and from cash flow

- £95 million from loan repayments following the merger of the Park Resorts Group and Parkdean Holidays

- £82 million from the sale of Zensar Technologies

- £57 million from the partial realisation of Allflex

- £33 million from the sale of Daler-Rowney

- £32 million in respect of realisations from secondaries

- £23 million from the sale of Kalle

Electra’s investment strategy and structure is different from that of almost every other private equity fund.

Electra invests across the full range of private equity opportunities: control and minority, equity and debt, direct and indirect. This means that Epiris can tailor its investment strategy to suit changing market conditions and invest where many others cannot.

More specifically, Epiris’ strategy is to focus on three areas of private equity investment:

1. Buyouts and Co-investments: direct investment in high-quality companies where there is an opportunity to buy well and then transform the business through strategic focus, operational improvement and M&A. As lead investor, Epiris typically targets investments of £40 million to £150 million in UK-centric companies with an enterprise value of up to £300 million. Epiris also coinvests £30 million to £100 million in minority positions in UK or international companies alongside founders, other private equity firms, corporates or the public markets.

2. Secondaries: secondary purchases of existing investors’ positions in either individual or portfolios of private equity funds, as well as acquisitions of portfolios of businesses, known as “secondary directs”.

3. Debt: loans to UK or international borrowers acquired in either the primary or the secondary market as either individual or portfolios of assets. The Debt portfolio comprises: performing credits, held either directly or through a structured finance vehicle such as a collateralised loan obligation (“CLO”), where Epiris has been able to secure attractive risk-adjusted returns and where a cash yield supports Electra’s distribution policy and liquidity needs; and stretched credits, which refers to debt in good businesses with bad balance sheets where Epiris can take a role in the restructuring of the capital structure.

Epiris applies the disciplines of buyout investing to its appraisal and management of investments in all three of these groups.

Epiris’ investment approach is based on the key principles of buying assets well, and then working closely with portfolio companies to improve business and operational performance in order to deliver returns from profits growth, cash flow and multiple expansion.

Buying Well

When making a new investment Epiris aims to find value by focusing on:

• Complexity: business or transaction complexity which causes attractive businesses to be undervalued; and

• Buy-and-build: growing platform businesses through bolt-on acquisitions which create value through greater scale, improved market positions and growth opportunities, as well as cost and revenue synergies.

Business Transformation

Epiris identifies and takes opportunities to transform the businesses in which it invests.

This means that before making a new investment, Epiris independently develops its own investment thesis and strategy, identifying the key drivers of investment return as part of its due diligence on each opportunity. It then works closely with a portfolio company’s management team in order to implement this strategy, and engages more broadly with the portfolio company itself as well as the industry within which it operates. In particular Epiris contributes to the development of each portfolio company, and therefore to Electra’s investment, in a range of areas including:

- M&A: identifying, originating and executing bolt-on acquisitions and mergers to transform portfolio companies’ scale, prospects and economics; and managing the exit of each investment to maximise returns;

- Management: building exceptional management teams; appointing non-executive Chairmen with complementary skills; changing and reinforcing executive management as required; aligning management’s interests with Electra’s through economic incentives;

- Strategy: increased strategic focus and clarity; business plan development begins prior to acquisition and is refreshed periodically through the life of the investment;

- Operational Improvements: using its own analysis and specialist external support to identify opportunities to improve the company’s cost and balance sheet efficiency and to invest for future growth; and

- Financing: ensuring that the company has a financing structure appropriate to its objectives, for example where there is a short-term change programme underway which requires flexibility. Well-structured financing can also contribute to other objectives such as hedging a company’s operational FX exposures.

Creating Returns

Epiris’ investment approach enables it to create returns by exploiting three principal value drivers:

• Profits growth: through organic growth, operational improvement and acquisition;

• Cash flow: allowing businesses either to invest in future growth or to deleverage; and

• Multiple expansion: reflecting buying well, strategic repositioning and selling well.

Electra’s objective is to achieve a rate of return on shareholders’ equity of 10–15% per annum over the long-term. Over the 10 years to 30 September 2016, Electra achieved an annualised diluted NAV per share return of 14% by implementing the investment methodology described above.

This return has been reflected in Electra’s share price. Electra’s share price total return over the same 10 year period was 237%, compared to 15% for the Morningstar Private Equity Index share price return (excluding Electra) and 76% for the FTSE All-Share Index.

Epiris operates a rigorous and disciplined investment model, as described below:

Origination - creating deal flow:

Systematic and repeatable processes using primary research and extensive networks of intermediaries, asset owners, industry experts and others to generate deal flow and unlock opportunities; prioritising deal flow depending on the fit with Epiris’ investment strategy; developing investment theses and strategies as well as relationships with target company management teams and vendors.

- 184 investment opportunities considered during the year to 30 September 2016

- 86% of completed UK buyout deals in Electra’s space seen in the year

Execution - making investments:

Evaluation and pricing of investment opportunities; in-house and third-party due diligence; raising debt from specialist capital markets; developing 100-day and business plans with management teams; winning deals; structuring, negotiation and closing.

- 2 Buyout and Co-investment, 1 Secondary and 6 Debt investments completed in the year to 30 September 2016

- Over £1 billion of new portfolio company debt raised in the year

Portfolio Management - creating returns:

Building exceptional management teams to drive profits growth and cash generation; working closely with the team to develop strategy, set targets, measure and manage performance; making use of M&A to drive strategic repositioning; and dealing with problems and opportunities.

- 10 portfolio company M&A transactions completed in the year to 30 September 2016

- 18% year-on-year profits growth in Buyouts and Co-investments portfolio*

Exit - realising the investment:

Identifying strategic / financial acquirers; timing the exit; creating buyer appetite and competitive tension; supplementing M&A with refinancings.

- £903 million of capital realised in the year to 30 September 2016

- Including c.£260 million of cash returned from repayment of loans in the year

Investment Process: pre-investment: monthly origination meetings; weekly and monthly

investment team deal flow meetings; weekly and ad hoc Investment Committee meetings to

consider new investments.

Investment Process: post-investment: weekly Investment Committee review of trading data; for each investment, 100-day review, biannual valuation process and annual strategy review.

Risk Management: pre- and post-investment: for new investments and the investment portfolio, the Investment Committee identifies, evaluates, monitors and manages risks including those relating to macroeconomic conditions, portfolio diversification, currency, liquidity and gearing, environmental, social and governance matters.

* Growth in Electra’s “share” of historical portfolio company earnings in respect of all investments over £5 million with the exception of CALA Group, Retirement Bridge Group and PINE which are valued on a net assets basis.

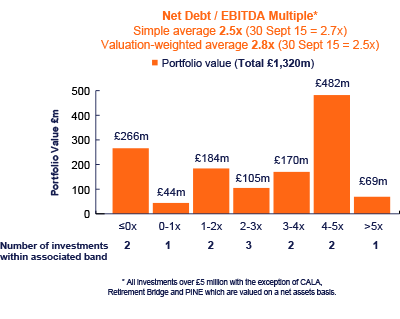

The chart below shows the number of Buyout and Co-investment companies, and the value of Electra’s investment in them, with net debt to EBITDA ratios in certain bands.

Electra has a policy to maintain total gearing below 40% of its total assets.

At 30 September 2016 Electra was ungeared at the group level.

As at 30 September 2016, Electra’s outstanding commitments to private equity funds and secondary funds were a total of £48 million. These are expected to be substantially funded by realisation proceeds from those funds. Electra also had cash of £659 million.

For a number of years Electra did not pay dividends unless required to do so to maintain Investment Trust status. In February 2015 a distribution policy was announced whereby Electra proposes to return to shareholders a targeted 3% of NAV per annum, by way of cash dividend or share buybacks. Any shares bought back under this policy will be cancelled.

In line with this revised distribution policy, the Company paid dividends totaling 116p in respect of the year to 30 September 2015.

An interim dividend of 44p per share in respect of the year to 30 September 2016 was paid to shareholders on 24 June 2016.

On 9 December 2016, the Board declared a second interim dividend in respect of the current year ending 30 September 2016 of 110p per share. This second interim dividend will be paid on 19 January 2017 to shareholders on the Register of Members at the close of business on 16 December 2016.

Following the declaration of this second interim dividend (which takes the total dividend for the year to 30 September 2016 to 154p), the Directors do not intend to recommend the payment of a further dividend in respect of the year to 30 September 2016.

A Dividend Reinvestment Plan (the “Plan”) has been arranged with Equiniti, the Company’s registrar, whereby existing shareholders have the option of reinvesting any dividend payments to buy more fully paid shares in the Company.

Please note that the Plan option will not apply to the second interim dividend due to be paid on 19 January 2017.

For further details on the Plan please call the Equiniti helpline on 0371 384 2351* (or +44 121 415 7047* if calling from outside the UK).

* Lines open 8.30am to 5.30pm (UK time), Monday to Friday, excluding UK bank holidays.

“Carried interest” is a commonly-used management incentive in the private equity market. It is designed so as to clearly align the interests of a fund’s manager with those of its investors. It works by awarding to the manager a share, typically 20%, of the difference between the total amounted invested in the fund and the cash realisations. Carried interest payments are made to the manager only once investors have received in cash all of their original capital together with a preferred return, typically 8% compounded annually and often referred to as the “hurdle”.

The alignment of interest is achieved by making sure that a fund’s investors get all of their original investment back in cash together with a minimum rate of return before the carried interest holders receive any payment. The compounding hurdle means that the time value of money is recognised.

Electra’s carried interest arrangements, which are similar to arrangements found elsewhere in the private equity industry, are designed to align Epiris’ interests with those of Electra’s shareholders.

The carried interest payable to the members of Epiris is based on three-year pools of investments. Under the terms of this arrangement all qualifying investments in a three-year period are aggregated into a separate pool. Electra must first receive back the aggregate cost of all the investments in the pool, plus related priority profit share and an 8% compound return. Once Electra has received sufficient cash to pay the amounts as described above the members of Epiris will be entitled to a carried interest of 18% of the profits. Consequently, they will receive the next 18/82 of the hurdle so that they will have an amount equal to 18% of the profits on the pool up to that point (this is referred to as a “catch up”). Thereafter, Electra and the members of Epiris will share future cash flows in the ratio of 82:18.

Below is an example to illustrate in principle how the above described arrangements work:

| £m | Assumptions | |

| Amount invested | 500 | Amount invested and priority profit share |

| Amount realised | 1,000 | Realised after year five |

| Pool profit | 500 | |

| Hurdle | (210) | 8% per annum compound |

| Catch up | 46 | 18/82 of the hurdle |

| Balance | 44 | The amount over the hurdle to get to an aggregate 18% of the pool profit |

| Total carry | 90 | 18% |

| Electra | 410 | 82% |

At 31 May 2017, when the contract with Epiris terminates, any provision on post 2006 Pools, which is unpaid at that date and any future uplift to it will be reduced by 20% which will revert back to the Company.

Deal volumes in the year to 30 September 2016 were significantly below the levels seen in previous years, even with a return to more normal levels in the fourth quarter.

Deal pricing has remained relatively strong, fuelled by a scarcity of assets and a plentiful supply of acquisition debt. Although the average entry multiple for UK buyouts valued at over £10 million fell slightly from 11.4x in the year to September 2015 to 10.8x EBITDA this year, it remains above the five and ten-year average, both of which stand at 10.4x (source: CMBOR).

A number of factors, relating both to private equity in particular and to financial markets more broadly, have increased asset prices as well as liquidity in the M&A and credit markets. At the same time, Electra’s portfolio of assets has matured as Epiris’ investment strategy has successfully created a portfolio of growth businesses which are of increasing interest to strategic and financial buyers alike.

Epiris has capitalised on this to deliver a record level of realisations during the year, £903 million in total. The Buyouts and Co-investments portfolio alone has generated realisations of £781 million and the weighted average exit multiple in this part of the portfolio was 13.4x EBITDA. This includes three exits to strategic buyers and one in an IPO.

On 26 May 2016 Electra announced that it had served notice of termination of the contracts under which the Company had wholly and exclusively outsourced all of the Company’s activities to Epiris, with termination becoming effective on 31 May 2017.

In carrying out its activities and in its relationships with the community, Electra aims to conduct itself responsibly, ethically and fairly, including in relation to social and human rights issues.

As an investment trust, with limited internal resource Electra has little direct impact on the environment. However, Electra believes that high standards of corporate social responsibility (“CSR”) make good business sense and have the potential to protect and enhance investment returns. Consequently, Epiris’ investment process ensures that social, environmental and ethical issues are taken into account.

Electra recognises and supports the view that social, environmental and ethical best practice should be encouraged.

Electra, as an Alternative Investment Fund, became subject to the AIFMD from 2014.

Epiris Managers LLP acts as Electra’s Alternative Investment Fund Manager (“AIFM”) under the AIFMD regulations.

The Board continues to be of the view that compliance with the AIFMD regulations will not materially affect Electra’s business.

At present, the CRC Scheme does not have a financial impact on Electra. The carbon emissions of any potential investments are part of the due diligence process.

FATCA is US anti-tax avoidance legislation aimed at ensuring that foreign financial institutions identify and report to their local tax authorities the names of those US citizens using such structures.

Electra is registered under FATCA, but as a listed investment trust it is not currently anticipated that its obligations under FATCA requirements will include the reporting of shareholder information.

In recent years, there has been a global movement towards greater tax transparency between countries with the aim of reducing tax evasion. The Common Reporting Standard (“CRS”) is a new regulation designed to facilitate the exchange of information between tax authorities in various countries. This means that all investment trusts, including Electra, now need to report certain details of their shareholders, such as the tax residency of each shareholder.

To ensure Electra complies with this legislation, Electra’s registrars, Equiniti, have started sending Self Certification Forms to both existing and new investors to capture the required information. Shareholders should complete the form and return to Equiniti as soon as possible.

If you have any queries please contact Equiniti on 0371 384 2351. Lines are open 8.30am to 5.30pm (UK time) Monday to Friday, excluding UK bank holidays.

If you are an existing shareholder and wish to buy more / sell your shares in Electra:

An internet and telephone dealing service has been arranged through Equiniti, which provides a simple way for UK shareholders of Electra to buy or sell Electra’s shares. For full details and terms and conditions simply log onto www.shareview.co.uk/dealing or call 0371 384 2351. Lines are open 8.30am to 5.30pm (UK time) Monday to Friday, excluding UK bank holidays.

The service is only available to shareholders of Electra who hold shares in their own name, with a UK registered address, and who are aged 18 and over.

Shareview Dealing is provided by Equiniti Financial Services Limited. Equiniti Financial Services Limited is authorised and regulated by the Financial Conduct Authority of 25 The North Colonnade, Canary Wharf, London E14 5HS (FCA reference 468631). Equiniti Financial Services Limited is registered in England and Wales with number 6208699.

If you are not an existing shareholder:

We recommend you seek your own personal financial advice from an appropriately qualified independent adviser or alternatively contact your own broker. Electra Private Equity’s shares are listed on the London Stock Exchange as ELTA.

Please note. The above information is not a recommendation to buy or sell shares. The value of shares and any income from them can fluctuate and you may get back less than the amount invested. If you have any doubt over what action you should take, please contact an authorised financial adviser.

In order to satisfy US Federal Securities laws, and the relevant securities laws of other jurisdictions including but not limited to Australia, Canada, New Zealand, Japan and South Africa, we are not at this time offering any securities in the US or to US persons, or to persons resident in certain other jurisdictions, including but not limited to Australia, Canada, New Zealand, Japan and South Africa. Therefore we are unable to send or otherwise provide you with any information or documentation regarding Electra, its business, or any future offers or sales of securities.

If you are a current investor, please contact the organisation/nominee company through which you purchased the shares who will hold copies of the Electra Private Equity financial reports.

All changes of address should be sent direct to Equiniti Limited, Aspect House, Spencer Road, Lancing, West Sussex BN99 6DA.

For further information on the Registrar and practical help on transferring shares or updating details, visit www.shareview.co.uk.

We are aware that in the past a number of shareholders have received unsolicited phone calls or correspondence concerning investment matters. These are typically from overseas based 'brokers' who target UK shareholders in operations are commonly known as 'boiler room' scams.

Some of the scams we are aware of that have targeted Electra shareholders are as follows:

• the offer to buy Electra shares at an inflated price to the market value. There is a risk that the recipient might not receive the money after the shares have been transferred

• the offer to buy Electra shares where a number of upfront payments are required first. Often if a victim makes the payment, the fraudster either invents a series of further fees for the victim, or simply disappears. This is known as “advanced fee fraud”

Please be very wary of any such calls or correspondence. Ask for the name and organisation of the person calling you and check if they can be found on the FCA Register. If they are not listed, please report it directly to the FCA using their consumer helpline (0800 111 6768) or at www.fca.org.uk/consumers/scams. You may also wish to advise us by telephoning 020 7214 4200 or emailing [email protected].

The Company, or its advisers, will only ever contact you in relation to official documentation already circulated to shareholders and never in respect of investment “advice”.

Please remember that if you use an unauthorised firm to buy or sell shares, you will not be eligible to receive payment under the Financial Services Compensation Scheme if things go wrong.

Electra currently conducts its affairs so that the shares issued by Electra can be recommended by IFAs to ordinary retail investors in accordance with the FCA’s rules in relation to non-mainstream pooled investment products and intends to continue to do so for the foreseeable future.

The shares are excluded from the FCA’s restrictions which apply to non-mainstream pooled investment products because they are securities issued by an investment trust.